Global risks to the EU natural gas market

Global risks to the EU natural gas market

Prepared by Jakob Feveile Adolfsen, Marie-Sophie Lappe and Ana-Simona Manu

The Russian war against Ukraine has both reduced gas supply to the EU and created risks for future supply.The amount of gas delivered from Russia to the EU fell to historically low levels at the end of 2022, reaching around 20% of pre-war levels. The fall in Russian gas exports to the EU started before the war, resulting in low gas storage levels already at the beginning of 2022. The response of the EU in implementing gas saving measures and sourcing alternative gas supplies – particularly by tapping LNG markets – bolstered the accumulation of gas in storage over the summer of 2022. Such measures provided some reassurance about the security of gas supplies for this winter, contingent on the weather not being too severe. However, the EU could face greater challenges when replenishing gas storage levels ahead of the 2023-24 winter. In particular, as gas supplies from Russia have dwindled, the EU has had to turn to global LNG markets. While this has alleviated immediate supply problems, it has meant that gas supply and prices in the EU have become more sensitive to swings in energy demand from the rest of the world, in particular from China. This box analyses the potential global risks posed to EU gas supplies in 2023 resulting from shifts in Russian supply and Chinese gas demand in a historically tight global gas market.

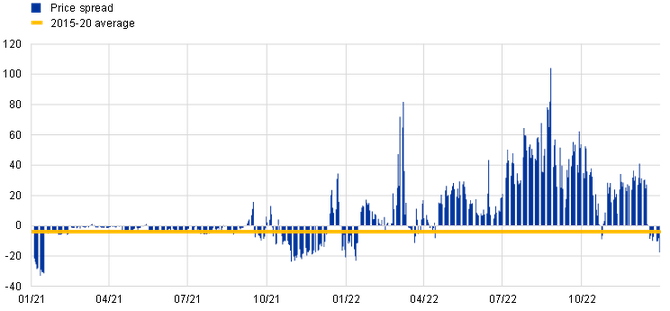

As supply from Russia has dwindled, the EU has turned to global LNG markets. As a result, EU and Asian gas markets have become increasingly interlinked. Historically, gas prices in Asia have traded at a premium relative to the EU. This is because Asia depends more on LNG to cover fluctuations in gas demand, while the EU has had access to cheaper pipeline gas, mainly from Russia (Chart A, panel a). This situation changed after Russia curtailed pipeline supplies to the EU and imposed unprecedented tightness on the EU gas market. To substitute Russian gas, LNG demand from the EU has risen over the last two years. As a result, the correlation between EU and Asian gas prices has increased substantially. This is because EU buyers are competing with Asian buyers and therefore need to pay a premium relative to Asian prices to attract the necessary LNG cargoes (Chart A, panel b). The correlation between EU gas prices and gas prices in the United States has increased to a lesser extent, as the country produces most of the natural gas that it consumes.

Chart A

Spread between EU and Asian gas prices and gas price correlations

a) Spread between EU and Asian gas prices

(EUR/MWh)

b) Correlations of Asian and US prices with EU gas price changes

(correlation coefficient)

Sources: Bloomberg and ECB staff calculations.

Notes: Panel a) shows the spread between TTF and JKM month-ahead prices. Panel b) shows correlations between the TTF and JKM/Henry Hub daily changes in month-ahead prices.

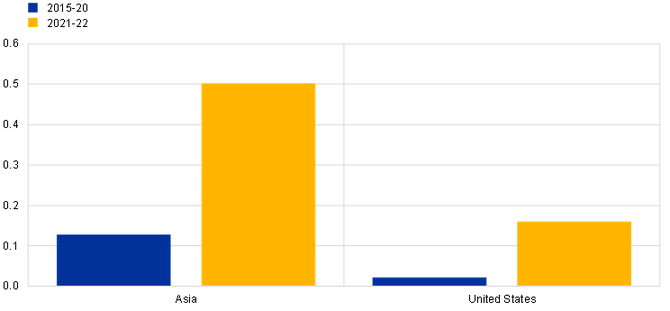

A rebound in Chinese LNG imports could constrain the EU’s ability to secure gas supplies throughout 2023. Increased EU gas imports in 2022 were partly enabled by paying higher gas prices but also by a significant drop in Chinese LNG demand. China’s LNG demand in 2022 was 22 billion cubic metres (bcm) lower than in 2021 (Chart B, panel a). Alongside lower consumption in other countries and an expansion in global LNG export capacity, mainly in the United States, the EU was able to import significantly more LNG than in the previous year (Chart B, panel b). The drop in Chinese LNG imports in 2022 interrupted a decade of increases in Chinese gas demand. In part, the slump in gas consumption may reflect China’s decision to switch to more coal power generation amid energy security concerns. However, the main driver was reduced gas consumption in the industrial sector[1], which was hit hard by the lockdowns during 2022. As a result of China’s exit from its zero-COVID policy at the end of 2022, increased economic activity will likely spur a rebound in LNG demand, adding significant pressure to the global LNG market, which is unlikely to see large expansions in export capacity until 2025.[2] This could constrain the EU’s ability to attract LNG imports, especially because China has the right to decide whether to buy a pre-agreed volume of LNG gas which amounts to a substantial share of global LNG cargoes.[3]

Chart B

Changes in China’s gas demand and global LNG imports

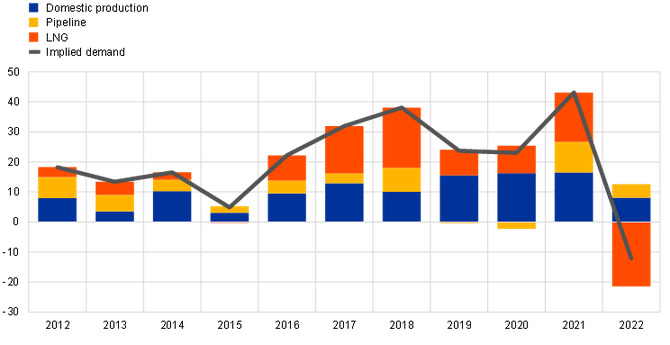

a) Annual changes in Chinese gas demand

(bcm)

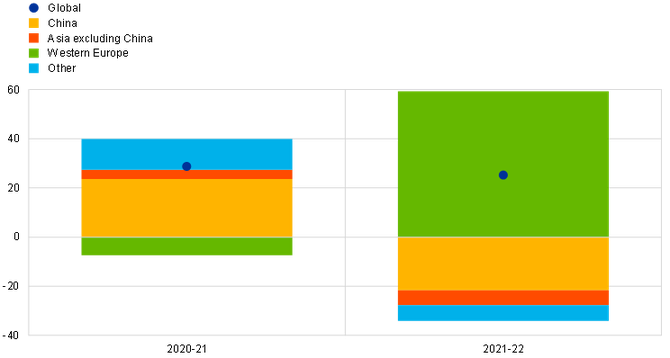

b) Annual changes in global LNG imports

(bcm)

Sources: Bloomberg and ECB staff calculations.

Note: In panel b, “Western Europe” includes Belgium, Finland, France, Gibraltar, Greece, Italy, Malta, Netherlands, Norway, Portugal, Spain, Sweden and the United Kingdom.

The risks posed by a rebound in China’s energy demand and a complete cut-off of Russian gas exports to the EU are highlighted by two illustrative scenarios for 2023. On the supply side, a benign scenario assumes that flows of Russian gas to the EU continue at current levels. Because Russian gas deliveries were reduced significantly throughout 2022, Russia would be delivering on average about 40 bcm less gas in 2023 than in 2022. It is also assumed that most of the expansion in global LNG capacity in 2023 will be secured by the EU. An adverse scenario assumes no Russian pipeline gas deliveries to the EU and a rebound in Chinese energy demand, which limits the EU’s capacity to secure extra LNG imports. On the demand side, in both scenarios it is assumed that the current EU-wide gas saving measures, currently only in place until March 2023, are extended to the end of 2023. It is also assumed that the EU will continue to require gas inventories to be filled to 90% capacity ahead of the winter.[4]

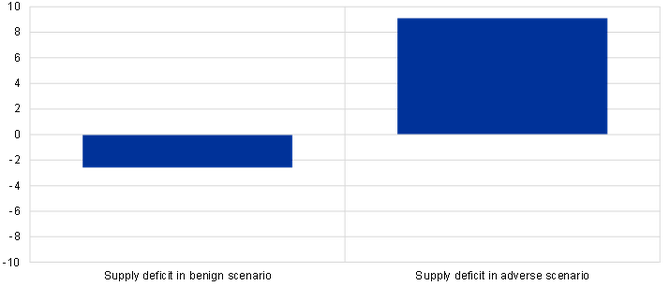

EU gas supply security remains vulnerable to global supply risks and changes in demand (Chart C). In the benign scenario, the EU natural gas market would be broadly balanced, whereas in the adverse scenario the gas deficit could account for about 9% of EU annual gas consumption. The deficit could fall to 4% if Chinese LNG demand stays unchanged at 2022 levels, or 2% if only the risks to Russian gas exports materialise. Such a deficit could probably be plugged by substituting gas with other energy sources, increasing energy efficiency and implementing a moderate drawdown of inventories.[5] Nonetheless, EU gas security in 2023 would remain vulnerable to further disruptions in gas supplies or shifts in demand. Although the EU has substantially reduced its dependence on Russian gas, it has become much more sensitive to swings in energy demand from the rest of the world, in particular from China.

Chart C

Two possible paths for the EU natural gas supply deficit

(percentages of projected 2023 consumption)

Sources: Eurostat, Refinitiv and ECB staff calculations.

Note: Assumptions regarding gas consumption, production, exports and imports are based on recent developments, the EU gas saving plan and the EU gas storage target for the end of October 2023.

The challenge for the EU to secure sufficient gas supplies in 2023 will also depend on the weather and depletion of gas inventories in the remaining part of the 2022-23 winter. EU Member States have saved more gas in the 2022-23 winter than envisaged by the EU gas saving plan, partly due to comparatively warm temperatures. As a result, gas storage levels have remained high and improved the outlook for gas supplies compared with expectations before the heating season started. However, if temperatures drop severely or there is a prolonged cold spell in the coming months, gas inventories could deplete faster than assumed in our analysis, leaving EU gas markets in a more vulnerable position. At the same time, warm temperatures during the winter months could place the EU in a stronger position to withstand the challenges in 2023, while high temperatures in the summer months would raise gas demand for electricity generation owing to an increased need for air conditioning.

The industrial sector accounted for more than half of China’s gas consumption in 2019.

It takes 5 years on average to establish a new LNG export terminal. Therefore, new investment projects prompted by the currently high gas prices are only expected to affect global export capacity at a later date.

According to the International Energy Agency, China increased its pre-agreed volume of LNG imports to 100 bcm in 2023, which amounts to 19% of global LNG imports.

In contrast to the December 2022 Eurosystem staff Broad Macroeconomic Projection Exercise (BMPE), the scenarios in this box are partial because they are not embedded in the broader analysis of the euro area, but focus on the interaction between economic developments and the demand for gas in China. The December 2022 BMPE downside scenario covers this broader analysis and focuses on risks to the euro area gas balance. See the box entitled “A downside scenario related to energy supply cuts” in the Eurosystem staff macroeconomic projections for the euro area (December 2022). The BMPE scenario entails euro area countries not being able to reach the 90% EU target for gas inventories in November 2023. In contrast to the BMPE scenario, this box does not assume a quick depletion of gas inventories owing to cold temperatures. This is because the current warmer-than-normal temperatures imply less risks to EU gas supply security in 2023 since the data cut-off date of the December 2022 BMPE in late November 2022.

See the International Energy Agency’s recent policy report entitled “How to Avoid Gas Shortages in the European Union in 2023”.

Sdílejte článek na sociálních sítích nebo emailem

Fotogalerie na bydlet.cz, nejlépe hodnocené fotografie

Články Energie

- České stavebnictví loni rostlo, přestože zakázek ubylo o pětinu. V Praze se začalo stavět méně bytů

- Sdílená energetika nabírá na síle. Electree radí, jak ji správně využívat

- Zahájení činnosti Národní platformy pro financování energetické účinnosti

- ČNB podle očekávání ponechala základní úrokové sazby beze změn, ceny bytů ani hypoték to neovlivní

- Zásoby plynu poklesly k 3. 2. na zhruba 39 %, stav zásob oproti stejnému období loňského roku je o necelých 5 procentních bodů nižší

- Pohonné hmoty v příštím týdnu zdraží, kvůli napětí mezi USA a Íránem

_w654h370.jpg)